Mobile banking seems like one of the most fortuitous advances in technology. It allows customers to easily and succinctly access their bank transactions, transfer funds and even pay their bills.

Also Read: How to link Aadhaar card to your Bank accounts

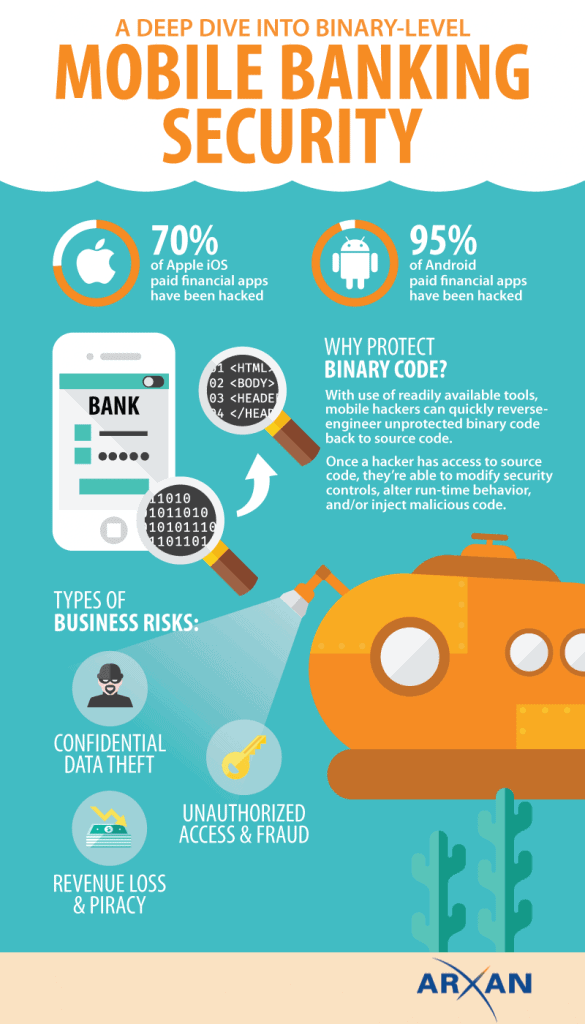

The problem is that it may be doing more harm than good by putting customers are risk for having their financial information stolen. Roughly 70% of iOS banking apps and 90% of Android banking apps have been misused.

Bonus: 30 Best Business Applications for Android devices.

Given that the Federal Reserve found that 52 percent of smartphone owners have used mobile banking, this means that millions of customers could be at risk.

Small businesses and businesses that have accounts designed specifically for employee usage are at an even greater risk. They are considered prime targets by hackers.

Why is Mobile Banking Dangerous?

There are three main reasons mobile banking is so dangerous: unsecured binary code, unsafe operating environments and nosy third-party apps.

Binary code that has not been obfuscated in any way is relatively easy for a hacker to reverse engineer. This can make encryption and any other employed security practices relatively easy to counter, which means that customers are essentially transmitting plain text information.

The next reason concerns the lack of reliable antivirus programs for mobile devices. Unlike PCs and MAC computers, there is no antivirus that efficiently prevents and treats viral infections. This gives users a false sense of security, which in turn exposes them to more dangers.

The last danger revolves around nosy third-party apps. These run in the background of phones constantly to monitor every piece of data. The data it collects, which can include financial information, is not always secured.

Making Mobile Banking Safer for Businesses

Given the unique set of problems with mobile banking, there are a few things that customers and businesses can do to safeguard financial information.

The first thing is to only install trusted applications on smartphones. The fewer applications that are installed, the less risk there is that a rogue app will collect sensitive information.

The second is to install an antivirus and a firewall. While these will not protect against every threat, they will help to prevent some.

The third is to choose to use mobile banking apps that have built-in security. These may be able to counter some of the risks that mobile banking brings.

Must Read: How to hide data inside another data – Steganography

Choosing a bank that provides extra layers of security is the fourth and likely most reasonable option. This can limit the damage that cyber criminals cause by making it significantly harder for false transactions to occur. Couple this with the ability for smart banks to stop widespread attacks, and mobile banking becomes much safer.